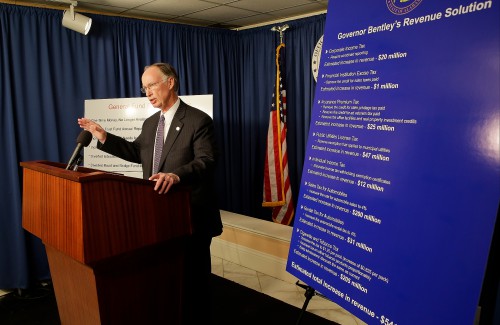

Governor Bentley Announces Solution for General Fund Budget Shortfall

MONTGOMERY—With a focus on tax fairness and debt repayment, Governor Robert Bentley on Friday announced his solution to fill a $700 million funding shortfall in the General Fund Budget.

The General Fund supports most non-education related functions of state government. For decades, problems have existed in the way funding was appropriated to the General Fund because of no growth taxes available to support it. A temporary solution for the past few years has been to support the ailing fund with one-time revenue. With mounting debts state government owes dating back to 2005 and no one-time revenue available, Governor Bentley has launched a new plan that will put the General Fund on a better, more sustainable, path forward.

“We have spent the last four years making government operate more efficiently and effectively, saving taxpayers over $1.2 billion annually,” Governor Robert Bentley said. “As we begin the 2015 Legislative Session, one of the most serious issues we face is the funding of our state’s General Fund. We have debts that must be repaid, and we must help our two largest agencies, Medicaid and Corrections, with funding increases. I am presenting a plan that will increase revenue for the General Fund and make taxes more fair and equitable for everyone.”

The Governor’s Revenue Plan includes eight options that total $541 million in estimated increases in revenue. When the Governor presents his budget options to the Legislature next week, he will also propose unearmarking $187 million to solve the financial shortfall in the General Fund. The Governor’s revenue options include:

- Corporate Income Tax

- Require combined income reporting for corporations that do business in other states.

- Estimated increase in revenue – $20 million

- Financial Institution Excise Tax

- Remove the credit that financial institutions receive for sales taxes paid

- Estimated increase in revenue – $1 million

- Insurance Premium Tax

- Remove the credit for state privilege tax paid by insurance companies

- Remove the credit for ad valorem tax paid by insurance companies

- Remove the office facilities and real property investment credits made by insurance companies

- Estimated increase in revenue – $25 million

- Public Utilities License Tax

- Remove exemption that applies to municipal utilities

- Estimated increase in revenue – $47 million

- Individual Income Tax

- Eliminate income tax withholding exemption certificates

- Estimated increase in revenue – $12 million

- Sales Tax for Automobiles

- Increase the rate for automobile sales to 4%

- Estimated increase in revenue – $200 million

- Rental Tax for Automobiles

- Increase the automobile rental tax to 4%

- Estimated increase in revenue – $31 million

- Cigarette and Tobacco Tax

- Increase the tax to $1.25 per pack (increase of $0.825 per pack)

- Increase tax on other tobacco products proportionately

- Keep wholesalers’ discount the same as current

- Estimated increase in revenue – $205 million

The Governor will officially present his General Fund recommendations to the Alabama Legislature on March 4.

“I believe this revenue plan is best for Alabama, and I look forward to working with the Legislature during the budget process. We were elected to make bold decisions that help Alabama, and I believe we will do just that,” Bentley added.

The Governor’s prepared remarks can be found here.

Video of the Governor’s remarks can be found here.

Provided by the Office of the Governor of Alabama | governor.alabama.gov